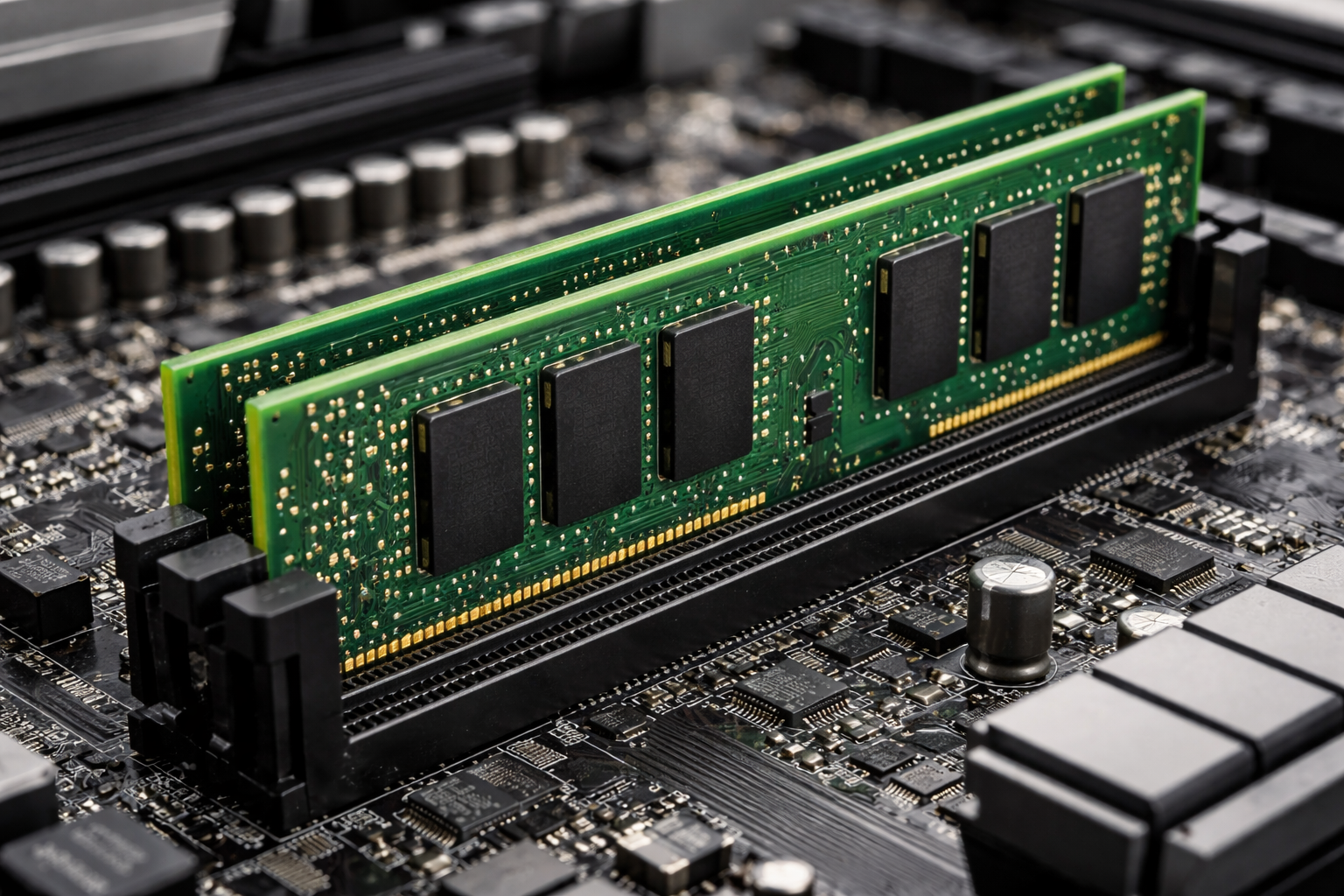

In 2026, the landscape for computer hardware (especially memory (RAM), solid-state storage (SSDs), and related components) is dramatically different from what many customers may remember. Instead of steady prices year-over-year, the industry is experiencing significant and rapid cost increases that are affecting everyone from individual consumers to large businesses.

What’s Driving the Market Volatility?

Over the past year, several structural factors in the global tech supply chain have converged to push component costs higher and make pricing much more unpredictable:

1. Explosive Demand from AI Data Centers

Advanced artificial intelligence systems require massive amounts of memory and high-speed storage. These AI workloads use High-Bandwidth Memory (HBM) and very large SSD arrays that consume enormous quantities of DRAM and NAND flash — the same core components used in PCs and laptops.

Memory manufacturers are prioritizing these high-value AI enterprise orders because they are more profitable and often contracted well in advance, absorbing a large share of available production capacity and limiting what’s left for consumer systems. This has tightened supply and driven up prices sharply.

2. Memory and Storage Supply Constraints

Factory production capacity for DRAM and NAND flash is not expanding fast enough to meet demand. Building and equipping new semiconductor fabrication facilities (“fabs”) takes years and billions of dollars, so supply is constrained at a time when demand is surging. Manufacturers have also shifted production lines away from older, lower-margin products toward advanced memory types, further reducing the availability of standard DDR and consumer NAND components.

3. Sharp Price Increases Across Key Components

Recent industry data and reporting show sustained and sometimes dramatic price increases across multiple component categories:

- Contract DRAM prices have surged by double-digit percentages, and analysts forecast continued sharp quarterly increases.

- NAND flash for SSDs has seen steep cost growth, including reports of wafer prices rising by more than 200%.

- Some industry reports predict broad price hikes for both DRAM and NAND memory throughout 2026.

These cost pressures don’t just affect standalone RAM or SSD modules — they ripple through the entire system. When memory and storage components become more expensive, OEMs and system integrators must pass those increases on in the price of desktops, laptops, and servers.

What This Means for Quotes and Pricing

Because of the current market environment being characterized by supply constraints, strong demand from AI and data centers, and rapidly changing component costs means that hardware pricing today can change significantly in a matter of days or weeks.

This volatility is not unique to our company or products as it reflects broader industry trends. In response:

- Quotes are provided with a clearly stated expiration date.

- Prices can only be guaranteed through that date.

- After that date, component costs may have changed enough to require a price revision.

This approach ensures that we can continue offering accurate and fair pricing while navigating an unpredictable market.

We appreciate your understanding and your business. If pricing adjustments are needed after a quote expires, we will communicate updated options transparently and work with you to find solutions that meet your needs.